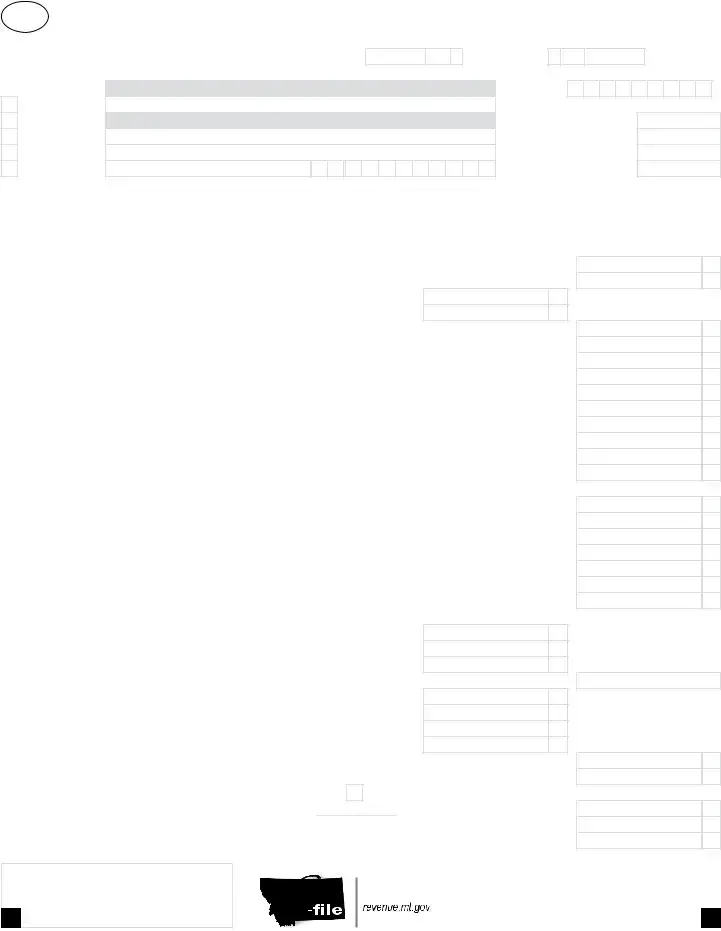

The Montana PR-1 form is reminiscent of the federal Form 1065, U.S. Return of Partnership Income. Both forms are used by partnerships to report income, financial operations, and distributions to partners. The Montana PR-1 requires a complete copy of the federal Form 1065, underscoring their intertwined nature. Each form collects detailed financial information, including income or loss from operations, deductions, and partner distributions, ensuring both federal and state tax obligations are met based on the partnership's operations.

Similar to Schedule K-1 (Form 1065), which is issued by partnerships to report each partner's share of the partnership's earnings, deductions, and credits to the IRS, the Montana PR-1 form also requires details about the distributive share of income to partners. It necessitates the inclusion of Schedules K-1 in the filing process, showcasing the allocation of income, gains, losses, deductions, and credits to the partners. Both documents are essential for partners to accurately report their portion of partnership income or loss on their personal tax returns.

The Montana PR-1 form echoes elements found in the Schedule IV – Montana Partnership Composite Income Tax Schedule, a specific component of the state's partnership filing requirements. This resemblance is due to its aim to calculate and report composite income tax for eligible partners, a process akin to consolidating tax payments or obligations for partners at the state level. This schedule facilitates a streamlined tax payment process for partnerships and their partners, similar to the PR-1’s overall objective of gathering and reporting partnership financial activities for state tax purposes.

Furthermore, the form parallels the information requested by Form 4797, Sales of Business Property, which is required for federal tax purposes. Both documents deal with the disposition of property and the associated gains or losses. The PR-1 requests details of net section 1231 gains or losses, which includes transactions reported on Form 4797, emphasizing the taxation of partnership property transactions both federally and at the state level in Montana.

Another document that shares similarities with the Montana PR-1 form is the federal Form 8825, Rental Real Estate Income and Expenses of a Partnership or an S Corporation. Both require detailed reporting of income and expenses from rental real estate operations. The PR-1 form specifically asks for net rental real estate income or loss, including amounts from Form 8825, ensuring that partnerships accurately report their real estate operations' financial impact at both the state and federal levels.

The form also aligns with the federal Form 4562, Depreciation and Amortization. Through its requirement for reporting section 179 deductions, the Montana PR-1 necessitates that partnerships detail their capital expenditures and depreciation claims, similarly to how Form 4562 is used to calculate and report depreciation for federal tax purposes. This connection underscores the tax implications of partnership investments in business assets, aligning state and federal tax reporting practices.

Last, the similarities extend to the Schedule I - Apportionment Factors for Multistate Partnerships, akin to various state and federal schedules aiming to allocate income and operations across jurisdictions. The PR-1 form's inclusion of apportionment and allocation schedules reflects the broader tax principle of determining tax obligations based on the geographical source of income. These elements are critical for partnerships operating in multiple states, ensuring taxes are accurately levied according to the origin of income and the presence of operations within Montana versus other states.

M

M D

D D

D 2 0

2 0  1 8

1 8 D D

D D Y

Y Y

Y Y

Y Y

Y 00

00

*18DY0101*

*18DY0101*

00

00 00

00 00

00 00

00 Yes

Yes

No

No