Purpose of this form

You may use this form to request an informal review of a

Notice of Assessment (NOA) or to request a waiver of penalty. An NOA is the first notice that the department will send you

if we adjust your return, change the amount you owe, or reduce your refund. It may come to you in the form of an audit determination letter, a return adjustment notice, or as

your first bill. An informal review is a written request to have a

department manager review the determination outlined in your

NOA. If you disagree with the NOA, use this form to begin

the informal review process. You must submit a request for informal review within 45 days of the date on your NOA.

A Statement of Account (SOA) is a bill that you will receive

if you do not request an informal review or pay the balance due showing on your NOA. You will continue to receive an SOA on a monthly basis until you pay the amount on the bill. If you disagree with a balance on an SOA, you may use this

form to tell us why you were unable to ask for an informal

review of the NOA you previously received. If we determine

that your failure to respond within 45 days was due to

reasonable cause, we will then evaluate your concerns over the NOA you received. Reasonable cause means that you

exercised ordinary business care but were still unable to meet a department deadline.

We will also accept a separate written request for an informal review of your NOA or SOA. You may mail, email,

or fax your request for informal review to the contact information in your notice or these instructions.

Penalty waiver

We automatically waive your late payment penalty if you

pay your tax and interest within 30 days of the date on your NOA. If you were unable to pay your tax and interest within 30 days of the date on the NOA due to unforeseen

circumstances, you can use this form to request a waiver of penalty if you believe you have reasonable cause. You must pay tax and interest before we can consider waiving any penalties.

Once we receive your request, an auditor will review it to

determine if you qualify for a waiver. We will send you a letter informing you of our decision within 30 days of your

request. If we deny your request for a waiver of penalty, you may request an informal review of our denial by filing

this form within 45 days of the date on our denial letter.

Appeal process and timing

When we make an adjustment to your tax return or amount owed you have the right to request an informal review for the department to review that change.

If you disagree with the adjustment on your NOA, you

must send us a written request for an informal review

within 45 days of the date on the NOA. Your request must

explain why you disagree with our adjustment. Include any documents that support your position.

Once we receive your appeal, it will be forwarded to a

department manager to review the adjustment. The manager will review your request and the work of the auditor who made the adjustment and send you a response within 45 days that outlines whether or not we agree with your request.

If you did not send your request for informal review within

45 days of the date on the NOA, we consider it to be a

deemed admission that you agree with our adjustment. At that point, you can no longer appeal the adjustment we made unless you demonstrate that you had reasonable cause for missing the 45 day deadline. We will review the

reasons you provide and determine if there is reasonable cause to review the adjustment. Once our review is

complete, we will send you a response with our decision.

If we determine that you had reasonable cause to miss your appeal deadline, you can file an informal review of the

adjustment we made to your return.

Our response will inform you if we agree or disagree with your appeal. It will also explain our reasons for disagreement so that you understand our decision. If you disagree with our decision, you may request further review by sending Form APLS102F,

Notice of Referral to the Office of Dispute Resolution, to the Office of Dispute Resolution within 45 days from the notice of determination date. The Office of Dispute Resolution is an

independent division within the department which may hear

taxpayer appeals at the request of the taxpayer. They can either act as a mediator or issue a final department decision.

Form APLS102F is available at MTRevenue.gov.

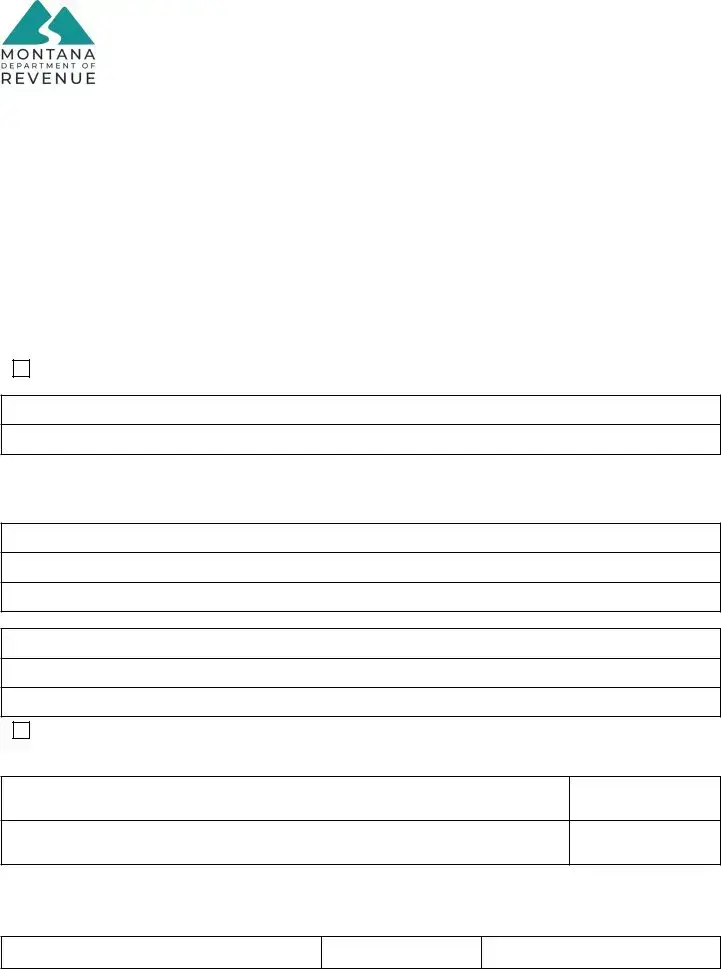

Filing this form

Email this form and supporting documents to

DORObjections@mt.gov. Mail to:

Montana Department of Revenue

DOR Objections

P.O. Box 7149

Helena, MT 59604-7149

Administrative Rules of Montana: 42.2.510, 42.2.512

Questions? Call us at (406) 444-6900, or Montana Relay at 711 for the hearing impaired.